By Matt Barrie & Craig Tindale.

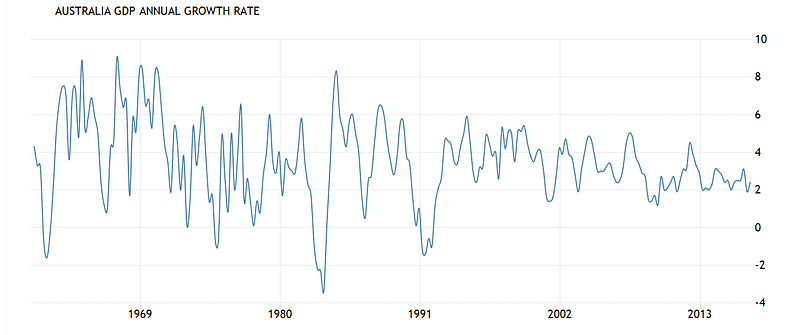

I recently watched the federal treasurer, Scott Morrison, proudly proclaim that Australia was in “surprisingly good shape”. Indeed, Australia has just snatched the world record from the Netherlands, achieving its 104th quarter of growth without a recession, making this achievement the longest streak for any OECD country since 1970.

Australian GDP growth has been trending down for over forty years

Source: Trading Economics, ABS

I was pretty shocked at the complacency, because after twenty six years of economic expansion, the country has very little to show for it.