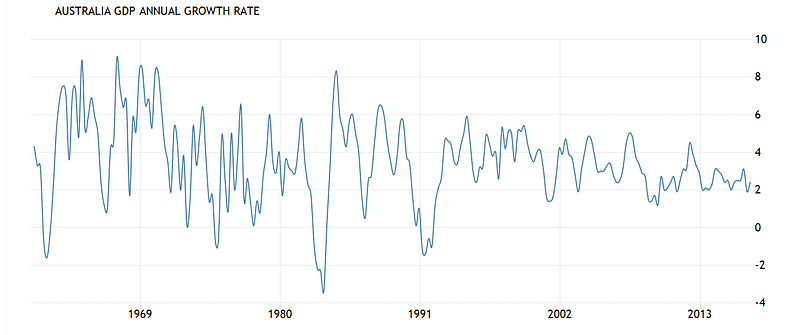

It goes without saying that I’m a Cassandra amongst the Pollyannas crowing about Australia’s current economic performance data. Low inflation, low unemployment, and no sign of a wages breakout, are the usually-quoted sweet economic indicators (admittedly with some strange bedfellows, including a relatively slow rate of economic growth for these conditions, and a huge balance of trade deficit despite the best terms of trade in history).

So how do I justify the stance of a Cassandra? Because things can’t continue as normal, when normal involves an unsustainable trend in debt. At some point, there has to be a break–though timing when that break will occur is next to impossible, especially so when it depends in part on individual decisions to borrow.