In my last post on my Debtwatch blog, I finished by saying that the Physiocrats were the only School of economics to properly consider the role of energy in production. They ascribed it solely to agriculture exploiting the free energy of the Sun, and specifically to land, which absorbed this free energy and stored it in agricultural products. As Richard Cantillon put it in 1730:

The Land is the Source or Matter from whence all Wealth is produced. The Labour of man is the Form which produces it: and Wealth in itself is nothing but the Maintenance, Conveniencies, and Superfluities of Life. (Cantillon, Essai sur la Nature du Commerce in Général (Essay on the Nature of Trade in General)

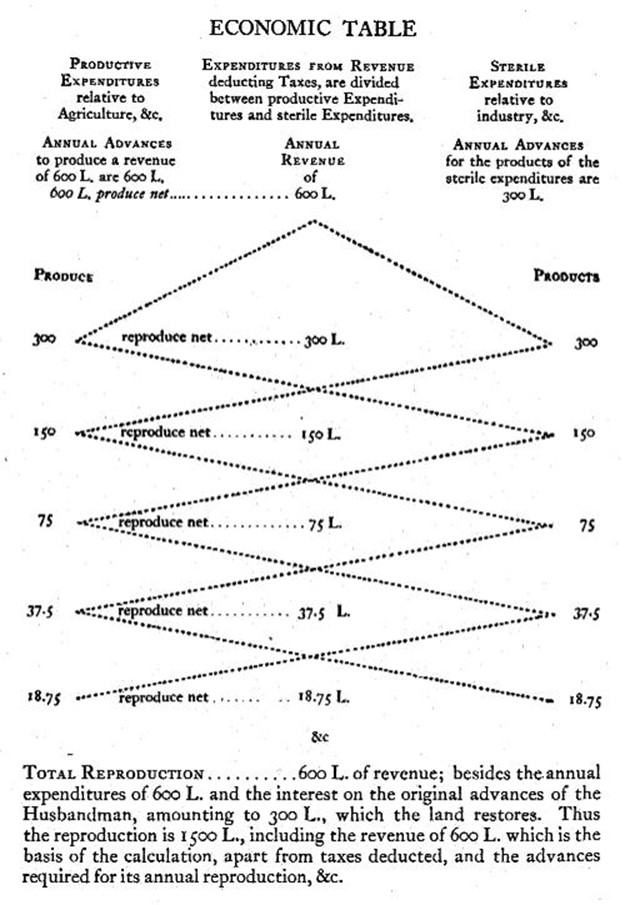

Quesnay’s famous but neglected “Tableau Economique” therefore described the agricultural sector as “the productive sector” and manufacturing as “sterile”—see Figure 1.

Figure 1: Quesnay’s “Tableau Economique”, first drafted in 1759, two decades before Watt’s steam engine

This was a justified assertion at the time, given that the Physiocrats wrote before the Industrial Revolution—and in particular the widespread exploitation in manufacturing of stored solar energy in fossil fuels– and originated in France, which was then overwhelmingly a rural nation.

Smith, who was influenced by the Physiocrats and wrote in Britain when industry was starting to exploit fossil fuels (specifically coal) on a grand scale, could have corrected this oversight. But rather than following the Physiocrats’ lead on energy, Smith instead saw labour—not energy—as the font of wealth (which he described in the same terms as Cantillon: the “conveniencies of life”), and ascribed the increase in productivity over time to “the division of labour”:

The annual labour of every nation is the fund which originally supplies it with all the necessaries and conveniencies of life which it annually consumes, and which consist always either in the immediate produce of that labour, or in what is purchased with that produce from other nations…

The greatest improvement in the productive powers of labour, and the greater part of the skill, dexterity, and judgment with which it is anywhere directed, or applied, seem to have been the effects of the division of labour. (Smith 1776, An Inquiry into the Nature and Causes of the Wealth of Nations)

Economics thus lost the Physiocrats’ focus on energy, and instead descended first into the “Labour theory of value” and then into the Neoclassical (and Post Keynesian) notions of “production functions” in which energy played no role at all.

The abiding weakness of all schools of economics, ever since the Classicals—including today’s Neoclassical and Post Keynesian schools, which are normally at pains to point out how superior one is to the other—is this failure to acknowledge the key role of energy in production. In this brief note, I want to record some speculations about how modern mathematically-inclined economics, with its use of production functions, might be made as energy aware as the Physiocrats were two and a half centuries ago. For the sake of non-mathematical readers, I’ve put the equations in an appendix at the end of this post.

Post Keynesian models typically see Output (Y) as a function of Capital (K) with a fixed ratio (v) between Capital and Output, and a fixed ratio (a) between Output and Labour (L) (see Equation 1).

When they go further than “corn economy” models, they employ a so-called “Leontief production function”, in which the ratio between capital and labour is fixed in each industry, though it varies between industries.

Neoclassical economists criticise this approach because it ignores the substitutability of capital and labour in production, which they embody in their core concept of an “isoquant” which alleges that the same level of output can be produced by very different combinations of labour and capital. Post Keynesians normally respond that this substitutability is a chimera, and continue using this “fixed coefficients” model of production anyway.

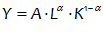

Neoclassicals typically see output as a function of capital and labour where one can be smoothly substituted for the other. Their canonical model is the Cobb-Douglas Production Function with constant returns to scale (Equation 2).

Neoclassicals tout this model’s fit to empirical data as a strength; Post Keynesians note that this is simply the result of accounting identities, since this “production function” can be derived by manipulating the identity that Output equals Wages plus Profits under conditions of a relatively constant (or slowly varying) distribution of income (see Anwar Shaikh’s brilliant paper “The Humbug Production Function”).

In this “he said/she said” battle, both sides ignore the shared weakness that their models of production imply that output can be produced without using energy—or that energy can be treated as just a form of capital. Both statements are categorically false according to the Laws of Thermodynamics, which—in strong contrast to so-called “Economic Laws” like the “Law of One Price” and the “Law of Demand”—cannot be broken. As Sir Arthur Eddington once put it:

The law that entropy always increases holds, I think, the supreme position among the laws of Nature. If someone points out to you that your pet theory of the universe is in disagreement with Maxwell’s equations — then so much the worse for Maxwell’s equations. If it is found to be contradicted by observation — well, these experimentalists do bungle things sometimes. But if your theory is found to be against the second law of thermodynamics I can give you no hope; there is nothing for it but to collapse in deepest humiliation. (Sir Arthur Stanley Eddington, The Nature of the Physical World (1915), chapter 4)

Arguably therefore, the production functions used in economic theory—whether spouted by mainstream Neoclassical or non-orthodox Post Keynesians—deserve to “collapse in deepest humiliation”.

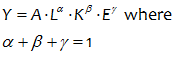

This unacceptable state of affairs has inspired a number of ecologically oriented economists to attempt to come up with production functions in which energy plays a crucial role. One such model is the LINEX (“LINear-Exponential”) or KLEC (“capital-labor-energy-creativity”) model used by Kummel, Lindenberger, Ayres and colleagues. At a basic level, this treats output as a function of labour, capital, energy and time—effectively adding Energy as a third input to the Cobb-Douglas model (Equation 3).

While this is an improvement on the basic Cobb-Douglas model, it still implies logically that the contribution of energy to production could be nil: just set its exponent ? to zero. This is still in violation of the Laws of Thermodynamics: we need a production function in which energy plays an essential and irreducible role.

A potential way to achieve this is to accept that the whole idea of “labour” and “capital” without energy is a farce: labour without energy is a corpse, and capital without energy is a sculpture.

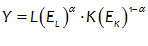

Why not acknowledge this by, as an initial abstraction, treating labour and capital as both being means to harness energy to do work, and treating output (Y) itself as work? Then we start from treating Labour and Capital as means to harness the energy they contain: EL for the energy flow that a worker can harness in a day, and EK for the energy flow that a machine can harness in a day (Equation 4).

The type and amount of energy that a worker or a machine can embody (as flows of energy at a point in time) are of course vastly different: the former is limited to food, and has a biophysical maximum (say, 5000 calories per day) whereas the latter can be the Sun itself directly, agricultural products, fossil fuels, or nuclear energy, and has risen from trivial levels before the Industrial Revolution to truly astronomical levels today.

Unpacking this further, we also need to acknowledge that not all the energy embodied in labour or capital can be used for work. Energy available to do work (these days called “exergy”) is the relevant factor, rather than the total energy embodied in labour or a machine; the efficiency with which that available energy is harnessed is also a vital ingredient.

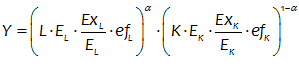

So rather than simply showing the energy embodied in labour and capital, we need to multiply it by the ratio of available energy (exergy, with ExL for labour and ExK for machinery) to energy, and by the efficiency with which that exergy is harnessed  . Then, using L to signify the number of workers and K (however imperfectly) to signify the number of machines, we get Equation 5, which treats output as a function of labour, capital and energy.

. Then, using L to signify the number of workers and K (however imperfectly) to signify the number of machines, we get Equation 5, which treats output as a function of labour, capital and energy.

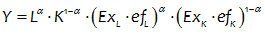

Rearranging Equation 5, we can derive the basic Cobb-Douglas formulation for labour and capital, times energy inputs. This is superficially like the Kummel/Ayres LINEX formulation, but it has the advantage that the energy contribution of either labour or capital cannot be set to zero without setting the contribution of the related “factor of production” also to zero, since they have the same exponents (see Equation 6). Energy therefore plays a crucial role in production using this formulation: if the energy input is zero, then so is output.

It may also transpire that the available energy embodied in machinery, and the efficiency of its exploitation, is the major explanation for the “Solow Residual”—the apparent paradox that, despite economists seeing output at any point in time as a function of labour and capital, the vast majority of the change in output over time comes not from an increase in the amount of Labour or Capital employed, but from the relatively unspecified A(t) term in the standard Cobb-Douglas function.

With this term replaced by two energy related terms—one of which  has a definite maximum (since there is only so much exergy that a human body can exert in a day, and this can comfortably be treated as a constant), the other of which

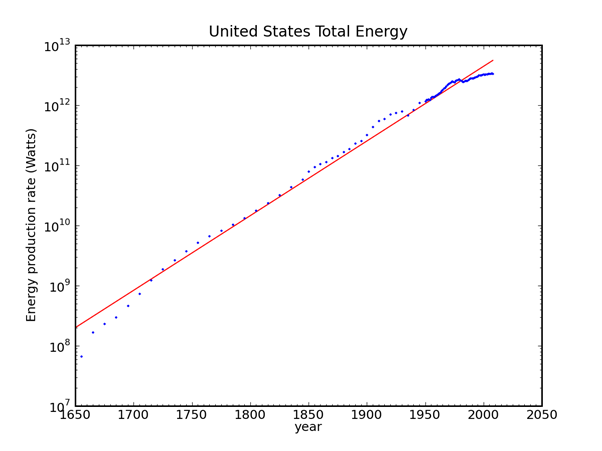

has a definite maximum (since there is only so much exergy that a human body can exert in a day, and this can comfortably be treated as a constant), the other of which  has gone from that of a water wheel in pre-Industrial times to that harnessed by the Spacex Falcon Heavy today—the “Solow Residual” may turn out to be the exponential increase in energy and exergy input into production over time (see Figure 2).

has gone from that of a water wheel in pre-Industrial times to that harnessed by the Spacex Falcon Heavy today—the “Solow Residual” may turn out to be the exponential increase in energy and exergy input into production over time (see Figure 2).

Figure 2: US Energy consumption over time

This energy-aware model of production is just a first step in properly integrating energy and the ecological effects of using energy into economics. It does not as yet consider the different types of energy resources, the impact of energy use upon energy resources and the ecology, or the mining (not “production”) costs of energy in terms of energy itself (the “Energy Return on Energy Invested” or EROEI). But it is necessary to have a model of production in which energy plays an essential role to be able to consider these issues about the viability of our energy usage properly.