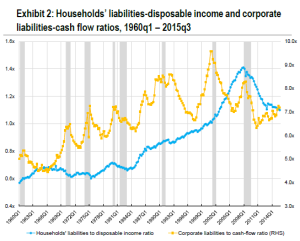

For the last 25 years, Australian politicians of both Liberal and Labor hue have been able to brag that, under their stewardship, Australia has avoided a recession. Those bragging rights are about to come to an end. During the life of the next Parliament — and probably by 2017 — Australia will fall into a prolonged recession.

Click here to read the rest of this post, and here to download the Excel file showing the link between a slowdown in the rate of growth of debt and a recession.