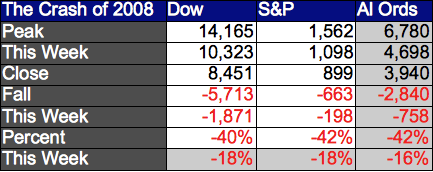

This week, financial markets truly succumbed to The Panic. The US Dow Jones and S&P500 Indices lost 21%; Australia’s All Ordinaries fell 16%. “Buy and Hold” gave way to “Get Out At All Costs”.

When we look back with the eyes of history, the ninth day of the tenth month of 2008 will be the Black Thursday on which the world’s biggest ever speculative bubble finally burst.

The Stock Market Crash of 2008