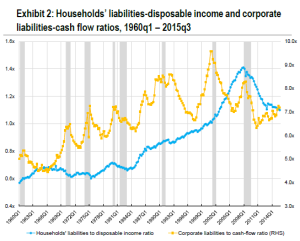

For decades, some of the most important data about market economies was simply unavailable: the level of private debt. You could get government debt data easily, but (with the outstanding exception of the USA—and also Australia) it was hard to come by.

That has been remedied by the Bank of International Settlements, which now publishes a quarterly series on debt—government & private—for over 40 countries. This data lets me identify the seven countries that, on my analysis, are most likely to suffer a debt crisis in the next 1–3 years. They are, in order of likely severity: China, Australia, Sweden, Hong Kong (though it might deserve first billing), Korea, Canada, and Norway.